Imf Definition Of Frontier Markets

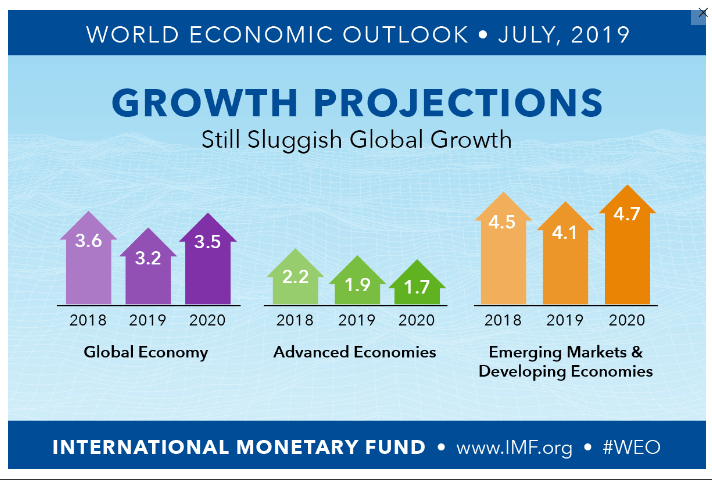

definition markets wallpaperHowever such recontracting is viewed with concern particularly by market participants. Advanced economies AEs and emerging market and developing economies EDMEs.

Net Household Savings Rate In Selected Countries 2019 Savings Household Basic Concepts

Net Household Savings Rate In Selected Countries 2019 Savings Household Basic Concepts

There is a group of fast-growing low-income countries that are attracting international investor interestfrontier economies.

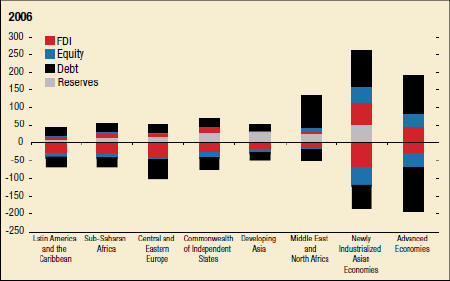

Imf definition of frontier markets. By Min Zhu and Sarwat Jahan Versions in Español عربي Countries will start a new chapter in their development this year with the United Nations Sustainable Development GoalsDesigned to replace the Millennium Development Goals these new goals will broaden the vision of development to embrace economic social and environmental issuesTo achieve these goals two elements are critical. At the same time iron-clad commitments to abstain from recontracting are untenable. I average annual portfolio flows to FMs as a share of GDP outstripped those to EMs by.

Based on the experience of EMs crises larger inflows into FMs have raised a number of questions from researchers and. The October 2019 Global Financial Stability Report GFSR identifies the current key vulnerabilities in the global financial system as the rise in corporate debt burdens increasing holdings of riskier and more illiquid assets by institutional investors and growing reliance on external borrowing by emerging and frontier market economies. Countries that dont put the money to good use may have trouble servicing their loans and find themselves at risk of default.

Low income developing countries LIDCS60 countries in allare a sub-group of lower income EMDEs defined in IMF 2014. Recently Standard Poorswhich in 2000 took over the emerging market financial indices from the International Finance Corporation IFChas used the term frontier markets to describe countries with markets that are smaller and less liquid than those in the more advanced emerging markets. The term is an economic term which was coined by International Finance Corporation s Farida Khambata in 1992.

TIMP is an acronym that stands for Turkey Indonesia Mexico and Philippines Similar to BRIC Brazil Russia India and China the acronym was coined by and investor. Emerging and Frontier Markets. Policy Tools in Times of Financial Stress.

This could be due to the size or geographical location of a country ie. Frontier markets are countries which are simply not on the radar of most investors. As developing economies become richer they seek to contract with the global economy in increasingly complex ways.

Improving economic prospects in these countries was a big factor but frankly so too was a global economy awash with liquidity. Several major banks produce indices of emerging and frontier markets including Bank of America Merrill Lynch Barclays Citigroup and HSBCbut JP. Frontier markets14 countries in allare LIDCs that have some degree of access to international capital.

After the unprecedented hit to economic activity in emerging market economies from the COVID-19 pandemic their economic output is projected to shrink by 33 percent in 2020. Morgans are the most popular benchmarks Table 82. Dealing with that complexity often implies the need to renegotiate contracts.

Frontier market designations are largely the domain of index families established by the international investment community. In more general terms it is widely accepted that frontier markets are perceived to be capital markets that are normally found in the developing world but are less advanced than those classed as emerging markets. Using a sample of developing countries covering the period 200014 we show that.

But there can be too much of a good thing. Three such indices are the. Get to know them.

Sub-Saharan Africas frontier marketsthe likes of Ghana Kenya Mauritius and Zambiawere seemingly the destination of choice for an increasing amount of capital flows before the global financial crisis. Jan 27 2021 in Uncategorized 2020s Worst Performing Frontier Markets Jan 27 2021 in Africa 2020s Best Performing Frontier Markets Dec 23 2020 in MENA MSCI Confirms Lebanon Will Lose Its Frontier Market Status In February 2021 Dec 23 2020 in Asia Kazakhstans Kaspi and Lithuanias Ignitis added to FTSE IOB Index. Understanding who they are how they are different and how they have moved themselves to the frontier matters for the global economy because they combine huge potential with big risks.

A frontier market is a country that is more established than the least developed countries LDCs but still less established than the emerging markets because it is too small carries too much. Posts about IMF written by James Eugene. The report proposes that policymakers mitigate these.

Rock bottom global interest rates have been a boon for so-called frontier-market countries which have been able to borrow cheaply to finance their development needs. A frontier market is a term for a type of developing countrys market economy which is more developed than a least developed countrys but too small risky or illiquid to be generally classified as an emerging market economy. This paper investigates to what extent low-income developing countries LIDCs characterized as frontier markets FMs have begun to be subject to capital flows dynamics typically associated with emerging markets EMs.

Frontier markets FMs together with low interest rates in advanced economies AEs heightened foreign investors interest in portfolio assets from those markets. This lack of development tends to mean that frontier markets are often characterised as being less liquid and more volatile than developed and emerging marketssometimes they are referred to by the investment community as emerging emerging markets. How many people can point out Latvia population 2 million on a map.

Https Www Imf Org Media Files News Seminars 2018 091318sovdebt Conference Chapter 9 Challenges Ahead Ashx

Chapter 1 A Decade After The Global Financial Crisis Are We Safer Global Financial Stability Report October 2018 A Decade After The Global Financial Crisis Are We Safer

Chapter 1 A Decade After The Global Financial Crisis Are We Safer Global Financial Stability Report October 2018 A Decade After The Global Financial Crisis Are We Safer

Types Of Enterprise Enterprise Sole Proprietorship Business Ownership

Types Of Enterprise Enterprise Sole Proprietorship Business Ownership

Chapter 2 Lessons For Frontier Economies From The Recent Experience Of Emerging Markets Frontier And Developing Asia The Next Generation Of Emerging Markets

Chapter 2 Lessons For Frontier Economies From The Recent Experience Of Emerging Markets Frontier And Developing Asia The Next Generation Of Emerging Markets

Pr Serenity Financial Forex Problems Solved By Blockchain This Is A Paid Press Release Which Contains Forward Looking S Financial Problem Solving Blockchain

Pr Serenity Financial Forex Problems Solved By Blockchain This Is A Paid Press Release Which Contains Forward Looking S Financial Problem Solving Blockchain

The Requirements For Emerging Markets Index Inclusion Schroders Global Schroders

The Requirements For Emerging Markets Index Inclusion Schroders Global Schroders

Chapter 6 Financial Sector Deepening And Transformation Frontier And Developing Asia The Next Generation Of Emerging Markets

Chapter 6 Financial Sector Deepening And Transformation Frontier And Developing Asia The Next Generation Of Emerging Markets

Chapter 1 Bridge To Recovery Global Financial Stability Report October 2020 Bridge To Recovery

Chapter 1 Bridge To Recovery Global Financial Stability Report October 2020 Bridge To Recovery

Chapter 1 The Growing Importance Of Frontier And Developing Asia Frontier And Developing Asia The Next Generation Of Emerging Markets

Chapter 1 The Growing Importance Of Frontier And Developing Asia Frontier And Developing Asia The Next Generation Of Emerging Markets

Issues Brief Globalization A Brief Overview

Issues Brief Globalization A Brief Overview

Chapter 4 Emerging And Frontier Markets Global Financial Stability Report October 2019 Lower For Longer

Chapter 4 Emerging And Frontier Markets Global Financial Stability Report October 2019 Lower For Longer

Chapter 8 Frontier Markets In Asia And Beyond Frontier And Developing Asia The Next Generation Of Emerging Markets

Chapter 8 Frontier Markets In Asia And Beyond Frontier And Developing Asia The Next Generation Of Emerging Markets

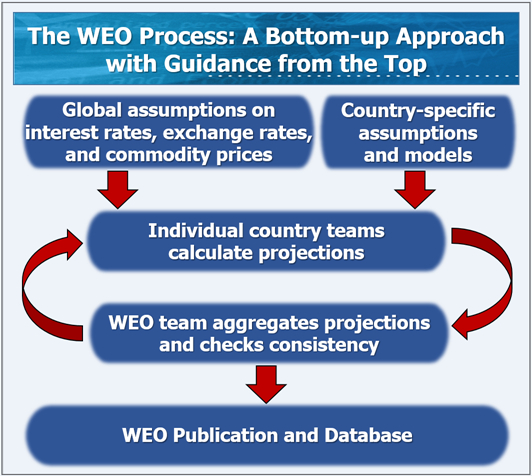

World Economic Outlook Frequently Asked Questions

World Economic Outlook Frequently Asked Questions

Amazon Has Posted A Profit For 11 Straight Quarters Including A Record 1 9 Billion During The Holidays Profit Amazon Jeff Bezos Revenue

Amazon Has Posted A Profit For 11 Straight Quarters Including A Record 1 9 Billion During The Holidays Profit Amazon Jeff Bezos Revenue

Https Www Imf Org Media Files Publications Pp 2020 English Ppea2020003 Ashx

Chapter 3 Diversification Growth And Volatility Frontier And Developing Asia The Next Generation Of Emerging Markets

Chapter 3 Diversification Growth And Volatility Frontier And Developing Asia The Next Generation Of Emerging Markets

Chapter 5 Achieving Inclusive Growth Frontier And Developing Asia The Next Generation Of Emerging Markets

Chapter 5 Achieving Inclusive Growth Frontier And Developing Asia The Next Generation Of Emerging Markets

Emerging Market Investing With Emf Provides Exposure At A Discount Nyse Emf Seeking Alpha

Emerging Market Investing With Emf Provides Exposure At A Discount Nyse Emf Seeking Alpha